Contents:

Additionally, note that with higher leverage, the risk of commodity trading rises too. So if you are a beginner, it is wise to consult research experts and monitor the market constantly. Online commodity trading in India has come a long way and has grown by leaps and bounds over the years. Currently, commodities trading in India spans both hard and soft categories. Hard commodities include metals, crude oil, precious commodities while soft commodities, which have a limited shelf life, include agricultural commodities like wheat, soybean, cotton, corn etc.

ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services. None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors. Excessive leverage is the main reason that more than 98% of new commodity traders lose money.

To hedge the https://1investing.in/ of this happening, farmers can take up a futures contract. So, when the prices fall in the local market, the farmers can compensate for the loss by making profits in the futures market. Inversely, if there is a loss in the futures market, it can be compensated for by making gains in the local market. There are several commodity trading apps in India where one can trade in equities as well as in metals and agro-products.

Gold – Precious Metals

U.S. stocks ended lower on Wednesday after minutes from the Federal Reserve’s March policy meeting revealed concern among several members of the Federal Open Markets Committee regarding the regional bank liquidity crisis. According to the official data released on Wednesday, India’s retail inflation or the consumer price index for March eased to a 15-month low of 5.66% from 6.44% in February. India’s factory output, based on the Index of Industrial Production , rose by 5.6% as against 5.2% in January. Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could fall 93 points at the opening bell.

Risk sentiment shifts in the global financial markets are not the only influence on gold; the precious metal is also bought as a hedge during extended times of low inflation. Commodity markets can include physical delivery, referred to as a spot contract. Most trades, however, are carried out through derivative trading using futures, forwards, CFD’s, and options. The prices of top commodities such as gold tend to rise over time, at a faster rate when compared to rising inflation rates in a country, allowing investors to enjoy a rise in the real value of their corpus investment.

- The ICEX not just allows trading in agri products, plantation , fiber , but also commodities like diamonds and steel.

- You can also trade in cereals, fibers, energy and gas, oilseeds, and other metals in India.

- Silver is another precious metal that is actively traded in India.

- The last method of trading or investing in commodities is through commodity pools and managed futures which are private funds that can invest in commodities.

- Alternatively, a market participant more familiar with commodities will tend to allocate much more of his/ her portfolio on commodities as compared to other types of securities.

Before we proceed further with the platforms on which commodity trading takes place in India, we need to have a look at the types of commodity trading that is most popular in India. As gold can be traded in contracts of different sizes as Gold mini, Gold Guinea, Gold Petal, etc. it is the most popular commodity to trade. If we combine all of these factors, natural gas can become a lucrative commodity to trade in.

Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could rise 11 points at the opening bell. The banking crisis in March took its toll on financial activity, particularly in the New York and San Francisco regions, according to the Federal Reserve’s periodic economic review released Wednesday. Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could rise 42 points at the opening bell.

Portal. Indian Online Stock Brokers Company offering Share Trading for BSE and NSE

These market actors can also use commodities derivatives to hedge future consumption or production. Speculators, investors, and arbitrageurs also play an active role in these markets. As pointed out in the previous section, the most common method of trading in commodities is through commodity futures. Commodity exchanges facilitate the transaction of such futures and other such derivatives. Such funds provide access to small investors who otherwise might not have access to sufficient funds to buy even a single futures contract of a commodity. Additionally such funds are low cost, highly liquid and provide tremendous diversification opportunities.

Iron ore slump deepens on China demand worries, ample supply – Nasdaq

Iron ore slump deepens on China demand worries, ample supply.

Posted: Mon, 24 Apr 2023 03:26:00 GMT [source]

The aluminium inventories at the exchange warehouse are witnessing continuous decline due to increased consumption demand following recovery in the global economic condition. Power rationing policies in China impacted the production to a large extent. With the right approach and expert guidance, commodities investments can be a profitable addition to an investment portfolio. As the US dollar is the largest traded currency in the world, there is a loose inverse correlation between the value of the dollar and commodity assets.

According to the International Copper Study Group’s supply-demand projections, world copper mine production climbed by 3.1 percent in the first nine months of 2021. The global refined copper output climbed by around 1.7 percent, with primary production increasing by 1% and secondary production increasing by 5.5 percent. Following the abolition of mobility restrictions and the global rollout of vaccination, consumer demand in 2021 grew steadily. The global economy is expected to grow due to improving economic conditions as reflected by numerous indices.

Inflation Hedge

Cut your portfolio’s expenses by opening deals on commodity CFDs with competitive spreads. Attention Axis Direct Investors Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. This means that you can get out of a contract, without taking the delivery of the commodity. You can simply pay the difference between the Buy and Sell contracts in cash. You need to square off or rollover the open position on or before start of Tender period. If the MTM % falls below the threshold% (65% to 70%) of the net margin deposit available with Axis Direct, then the customer needs top up the funds immediately, failing which Axis Direct will square off the open position.

- Commonly traded livestock and meat commodities include lean hogs, pork bellies, live cattle and feeder cattle.

- Commodity prices are influenced by several factors which should be researched thoroughly in order to employ effective trading strategies.

- Before placing a trade, one must have an idea about the actual demand of the commodity in the local markets.

With the rise of online commodity trading, investors in India can easily access these commodities and profit from their price movements. Crude oil is India’s most actively traded commodity, with a whopping 88,97,648 lots traded in January 2023. It is traded on the Multi Commodity Exchange of India Limited , which is the largest commodity exchange in India and a leading platform for crude oil trading. The MCX is the top global exchange for gold, silver, natural gas, and crude oil trading. In fact, 85% of MCX’s turnover comes from gold, silver, copper, and crude oil. These players may try to exit their short or long positions the same day or after a few days.

Best commodities to invest in 2021: Crude oil, Gold, Copper. Commodity brokers in India – Zerodha, Upstock

Producers, manufacturers, etc. usually hedge their risk by using commodity futures market. There is a wheat farmer and if there is fluctuation of prices during harvest and if price falls, farmer would face loss. When there is fall in price in the local market, the farmer can compensate this loss by making gains in the futures market. In case there is increase in price during harvest, the farmer would face loss in the futures market but he can compensate this loss by selling it at a higher price in the local market. Manufacturers and producers typically hedge their risk with the help of the commodity futures market. For example, if prices fluctuate and fall during harvest, farmers will have to face a loss.

Nonetheless, a futures contract tends to merge with the spot price at which a commodity is trading at a future date, as prices adjust automatically at the expected level. If such trade is supervised by commodity exchange, it is known as a future derivative contract. Any settlement between two parties without any overseeing exchange is known as over the counter exchange trading. US stocks ended mixed on Wednesday as investors look towards OPEC+ production cuts and inflation impact of the same with uncertainty still looming for the global economy. Overseas, Asian stocks are mostly higher on Monday as some investors returned from a long Easter weekend. Australian and Hong Kong markets remained closed due to a four day Easter holiday till Monday.

Crude oil is a highly sought-after commodity as it is a primary energy source, with demand coming from various industries such as transportation, manufacturing, and construction. This has made it easier for individuals to trade in commodities and take advantage of market movements. In this article, we will be discussing the 5 most traded commodities in India. Please note that other exchanges have different lists of most traded commodities.

Like how to earn bitcoin 5 simple ways to earn more btc, gold is also one of the highest traded commodities. The price of gold is influenced by many factors such as demand and supply, movement of the US dollar, inflation, global uncertainty, demand by central banks, etc. The Indian financial market offers numerous ways, apart from equity, to invest, diversify and ensure a positively healthy portfolio. The commodity market in India is over 100 years old but was officially established through a legal trading mechanism in the year 2003. As every country relies on raw materials to grow, the commodities markets have a special place in driving a country’s economy and allowing investors to profit along the way. In conclusion, commodity trading in India is a popular and lucrative market, with several commodities actively traded online.

Pay 20% upfront margin of the transaction value to trade in cash market segment. When inflation rises, the value of the currency goes down and therefore people tend to invest in gold as it acts as a hedge against inflation. The prices are also affected by imports and exports, economic growth, storage levels, etc. Thus, aluminium becomes a great commodity to trade in as it has a wide score of price fluctuations. The cost of making aluminium also varies according to the prices of oil and electricity. Aluminium is obtained from Bauxite and China is the biggest producer and consumer as well.

Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could rise 7 points at the opening bell. Some Southeast Asian markets are closed today for a holiday, including Singapore, Malaysia and Indonesia. Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could rise 58 points at the opening bell. Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could rise 21 points at the opening bell. Data showed that gross domestic product rose at an annual rate of 1.1% in the first quarter of the year. That was down from a 2.6% increase in the final three months of 2022.

FACT SHEET: President Biden to Catalyze Global Climate Action … – The White House

FACT SHEET: President Biden to Catalyze Global Climate Action ….

Posted: Thu, 20 Apr 2023 07:00:00 GMT [source]

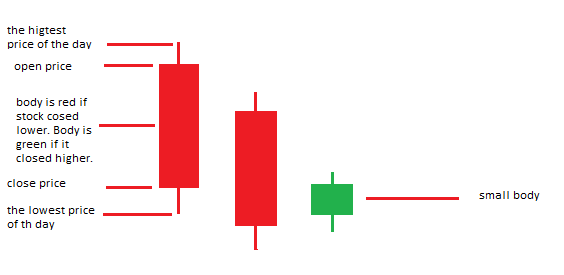

It helps understand the the trading concepts in the commodity futures market with examples. It also explains the fundamentals of options trading in commodities and how to use them to hedge/trade using multiple different situations. A tradable commodity can be bought and sold, just like you trade in equity/shares.

Types of commodities traded in India (MCX):

Another option of trading in commodities is to buy the stock of a company involved with a commodity. For example, an investor may buy the stock of a copper refining or drilling company in an attempt to bet on the prices of copper going up. On the exchanges, you can trade in hard as well as soft commodities. Hard commodities include crude oil, metals, etc. and soft commodities generally have a shelf life and include agricultural commodities like wheat, soybean, corn, cotton, etc. There is nothing like the best commodity but ideally traders should focus on the commodity that is most liquid.

Moreover, because commodity prices tend by more volatile than stocks and bonds, commodities trading is often most suited for those with higher risk tolerance and/or longer time horizon. Certain commodities, such as precious metals, have been thought of to be a good hedge against inflation, and a broad set of commodities as an alternative asset class can help diversify a portfolio. Because the prices of commodities tend to move in opposition to stocks, some investors also rely on commodities during periods of market volatility.

Gold ends April with little fanfare, but record-high prices may be ‘inevitable’ – MarketWatch

Gold ends April with little fanfare, but record-high prices may be ‘inevitable’.

Posted: Fri, 28 Apr 2023 18:50:00 GMT [source]

Examples of commodities in the market that were most commonly traded in major commodity exchanges in India included crude oil and silver. While crude oil acts as one of the most important energy sources required for virtually every industry, silver is one of the most precious metals other than gold with a steady demand. These traders constantly analyze the prices of commodities and forecast the future price movement.

These markets first developed as a place to buy and exchange agri-produce, metals and other useful commodities which were prevalent in the course of history. The development of commodity markets laid the foundation for all other markets and thus, it is very important to understand it in detail. Unlike equities, the ground realities of the commodity markets are vastly different and the factors which affect prices are more specific and less correlated to other commodity baskets. In this module, you will learn all about commodities, their fundamentals, demand & supply factors, different uses, production/extraction details, etc.

Top oil producing countries in the world are US, Saudi Arabia, Russia. Armed with vital knowledge on the types of commodity trading, types of commodities, and price movements, your commodity trading journey will be smooth-sailing. Spot markets are also known as “cash markets” or “physical markets” where traders exchange physical commodities, and that too for immediate delivery. Typically, commodity trading occurs either in derivatives markets or spot markets. 4) No need to issue cheques by investors while subscribing to IPO.